Lakeshore is ending its 2019-2020 Financial Year (FY) on 30 April under the exceptional and stressful circumstances of the coronavirus pandemic. However, as a community, we have shown great resilience and have come together through on-line services initiated and organized by Gary Spiller on the Zoom platform.

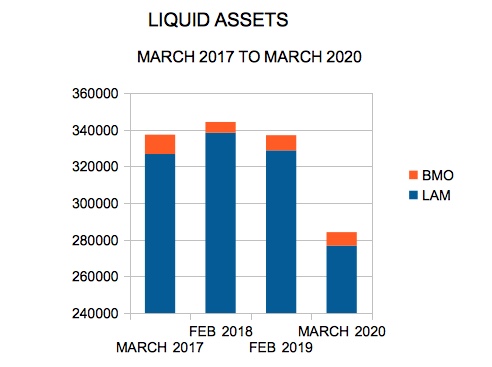

Of course, the pandemic with the resulting sudden economic recession has had a major impact on Lakeshore’s investments with Lester Asset Management (LAM). We started our current FY in May 2019 with just over $ 334 000 and at the end of February, having drawn out $ 10 000 for expenses during the year, we stood at about $ 324 000. Then, boom, we lost $ 50 000 in March in market valuation. (April is not yet available.) However, we have NOT realized any losses for we hold on to our long-term investments and there is a good chance that within two years, if not sooner, there will be a fair degree of recovery of the lost ground. And when we draw down on our LAM account, the money comes out of the interest-bearing savings portion (about a third of the total), which still grows very modestly, and NOT out of the long-term investment portion which is suffering the ups and downs of the stock market.

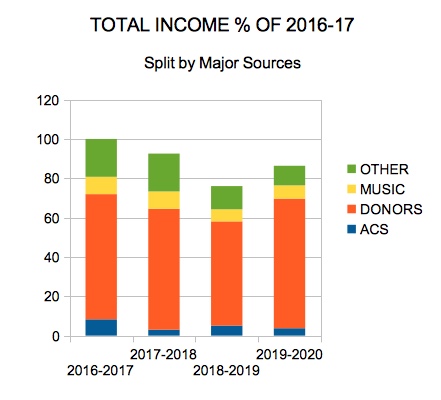

On the income side, as the Income graph below shows, we actually did better than in 2018-2019, despite contributions made during Sunday Services having disappeared over the last two months and the Service Auction being postponed to this autumn (hopefully). Without going into too much detail, I will just note that in most categories of income, except fund-raising, we came close to or even exceeded our 2019-2020 budgeted goals.

In addition to generous contributions to our general operating budget, extra donations were made by several people to the Youth budget with a view to sending four of our young people to the Canadian Unitarian Council gathering in Halifax, scheduled for May 2020, but sadly canceled due to the pandemic. We also gave generously to the Sharing Our Faith collection and to the Maple Grove school Christmas baskets via the Society St. Vincent de Paul.

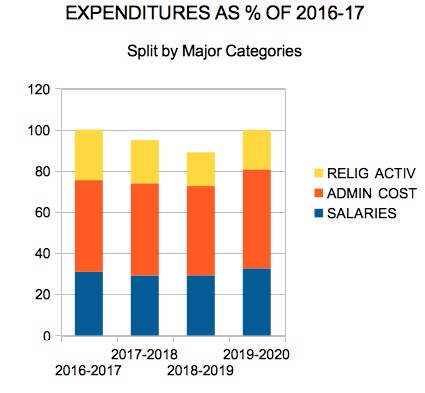

On the expenditure side, the Covid-19 virus had much less impact as we pay for rent, telephone, internet services and employee salaries even though we have switched from using a physical site to a virtual one, thanks to the Zoom platform. During this year, we increased the honorarium paid to outside lay speakers from $ 100 to $ 125, while fees to religious peakers stayed the same. In terms of Property expenses, we purchased a new copier / printer (with a maintenance contract). We were also hit with a major proposed inscrease to our insurance premiums, but by recalibrating our coverage to take into account our actual property inventory and our substantial investments, we kept the actual expense to just a little more than the budget envelope.

Looking at the Expenditures graph below, we can see that our expenses are at just about the same level as in 2016-2017. Unfortunately, our Income has not gone up to the 2016-2017 level. The absence of weekly contributions by members and friends attending the services and the damper put on fund-raising activities make the outlook for the coming year a wee bit more problematic.

Fortunately, there are a number of members and friends able to pledge each year a regular financial contribution, sometimes in the form of post-dated monthly cheques. We are hoping that most of these regular donors might still be able to continue their traditional support of Lakeshore, despite the hard economic times we are going through. See also the item ”Security Is No Longer A Question” in the 2020-04-24 Mini-Newsletter, about how you could contribute from time to time to our community’s financial well-being.

Christopher Thomson, Treasurer 2016-2020 – 24 April 2020